Indiana Swimming Pool Financing for 2019

So your family wants to have a new In-Ground Swimming Pool installed during 2019. Our average priced pool last year, including all options, but excluding landscaping, exceeded a price of $60,000! Add in landscaping and more money if your pool is higher than the average and it is no wonder that we are often asked what we know about financing an in ground pool in Indiana in 2019! If you are relying on financing for your pool, this is something you will want to explore BEFORE you spend too much time on the pool buying process!

So what are the financing options? How much a month will a loan cost? What kind of interest rates can you expect? Can you write the yearly interest off your taxes? Each person’s situation will be different and rates change but here is some great information as of November 1, 2018!

There are mainly two financing options available.

Home Equity Loans. The first choice is often a Home Equity Loan (aka second mortgage loan) because of the lower interest rate. As of November 1, 2018, at our most popular lender, fixed rates are approximately 5.5-6.5% per annum (assumes <90% LTV, , fixed rate for a 15 year term and 700 credit score and a good debt to income ratio, maybe 50%).

Home Equity Loans cannot exceed 90% of the appraised value of your property less the balance of your first mortgage loan. Flaws in your personal credit rating are more tolerable since your property is the collateral. The terms are very flexible and can be spread out for up to 25 years in some cases.

So let’s make up an example of how a Home Equity Loan might work: Your house value is $400,000,and after subtracting your first mortgage loan of $300,000 you determine that you have $100,000 of equity in your house. But since your bank will only allow total loans equaling no more than 90% of the value on your house (ie 90% x $400,000 = $370,000 less $300,000 in liens leaves a maximum of $70,000 to be loaned), you will only be able to borrow $70,000 based on equity and a 90% LTV requirement.

So let’s say your pool project is $80,000 under the above scenario. That means you will have to come up with $10,000 and then you could borrow $70,000. Assuming you meet the lender’s other requirements, including required credit scores, your $70,000 loan might get an approximate interest rate of 6% with payments of $ 590 per month fixed for 15 years or $501 per month for a 20 year loan.

These loans take 30 days or more to close because they require an appraisal, title work and closer scrutiny.

Unsecured Signature Loans. If you don’t want to grant a second mortgage on your property, getting a pool loan will require a good credit score and debt to income ratio and the interest rate will be higher.

Unsecured signature pool loans, as of November 1, 2019, at our favorite lender, have a fixed interest rate ranging from about 7.5-8% . The lending institutions are more “stringent” on your credit score with most requiring a 700 or better to apply for the better rates. You will probably be required to pay 10-20% of the purchase price in cash the the loan will be for 80-90%. The lender will be hoping for a debt to income ratio of 45% or better to get the better rates. The interest you pay is NOT tax deductible but fortunately most pool loans can be stretched out for up to 12 yrs. A $60,000 12 year fixed rate loan at 7.8% would require monthly payments of $643.

Unsecured loans may take as little as a week, from the date of full application, to fund.

For ALL Central Indiana residents….after checking with your current lenders you may want to also compare programs with the following lending institutions:

Key Bank: (home equity and unsecured pool loans)

Chris Welling Ph 317-215-7611

Also at Key, Mary Lee, 317-215-7613

Light Stream Financial (a Division of Sun Trust Bank) (unsecured loans):

https://www.lightstream.com/swimming-pool-financing

With Perma Pools, your salesman can further talk to you about these two lenders and can give you some more thoughts about the current state of pool financing.

I hope this information was helpful as you begin the process of securing the needed funds to build your dream pool for your family!!

fiberglass pools

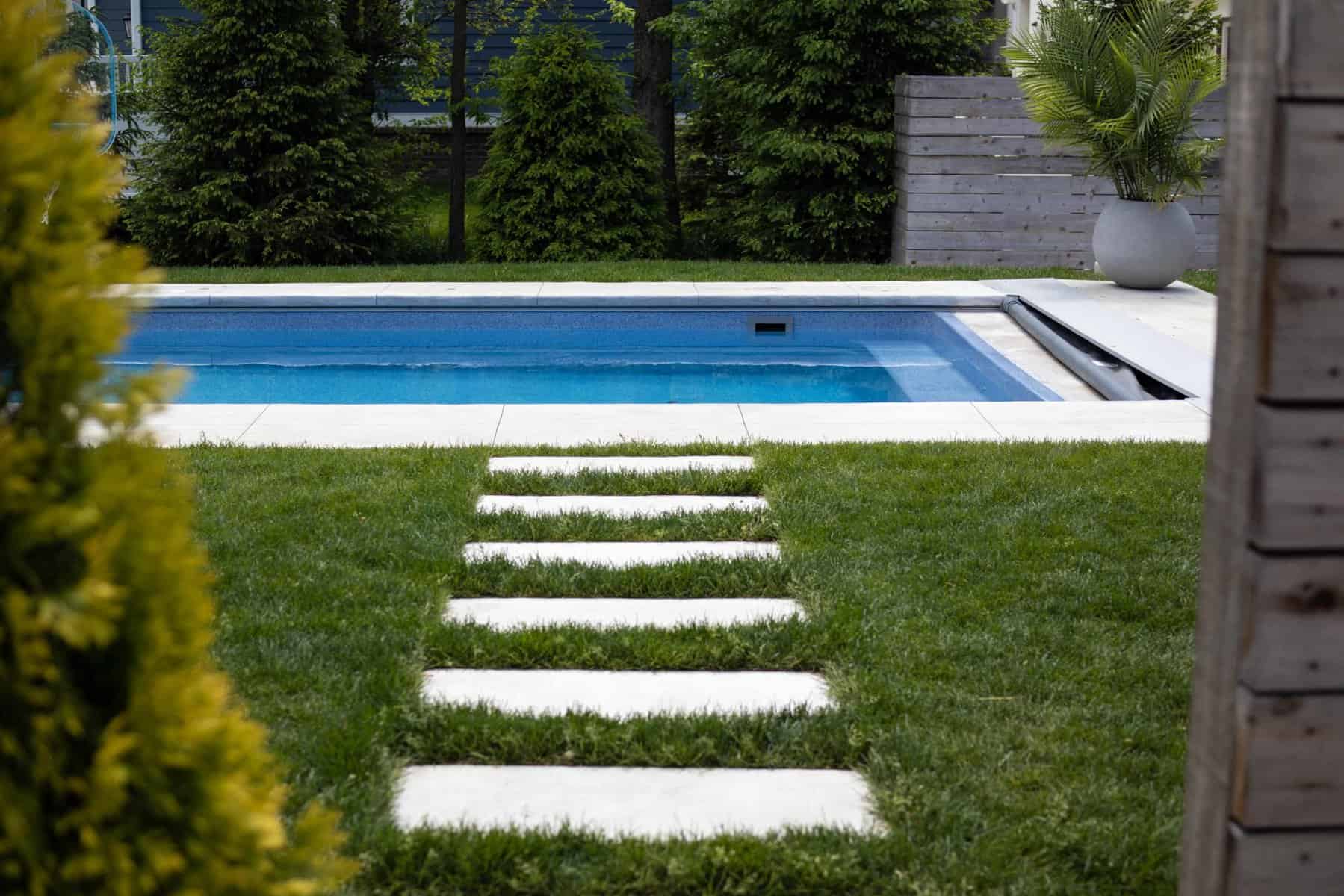

Ready to build a fiberglass pool in central Indiana? Perma Pools is here to help! Fiberglass pools are quick to install and typically run up to 16 feet wide and 40 feet long.

vinyl liner pools

Perma Pools is ready to help you save money on your brand new pool! Our vinyl liner pools are a great budget-friendly option and are highly customizable.

Pool services

Our certified pool technicians are ready to bring your pool to life! We work year-round to service your pool and keep it well maintained for years of fun!

Automatic Pool Covers

Perma Cover Services offers sales and installation of fully automatic deck mounted and recessed retro automatic pool cover systems.